Exactly what fico scores do i need to get a consumer loan?

- Even though you do not need to has the ultimate credit rating to obtain a personal loan, lenders basically discover people who have credit ratings of 600 or above since the lower chance.

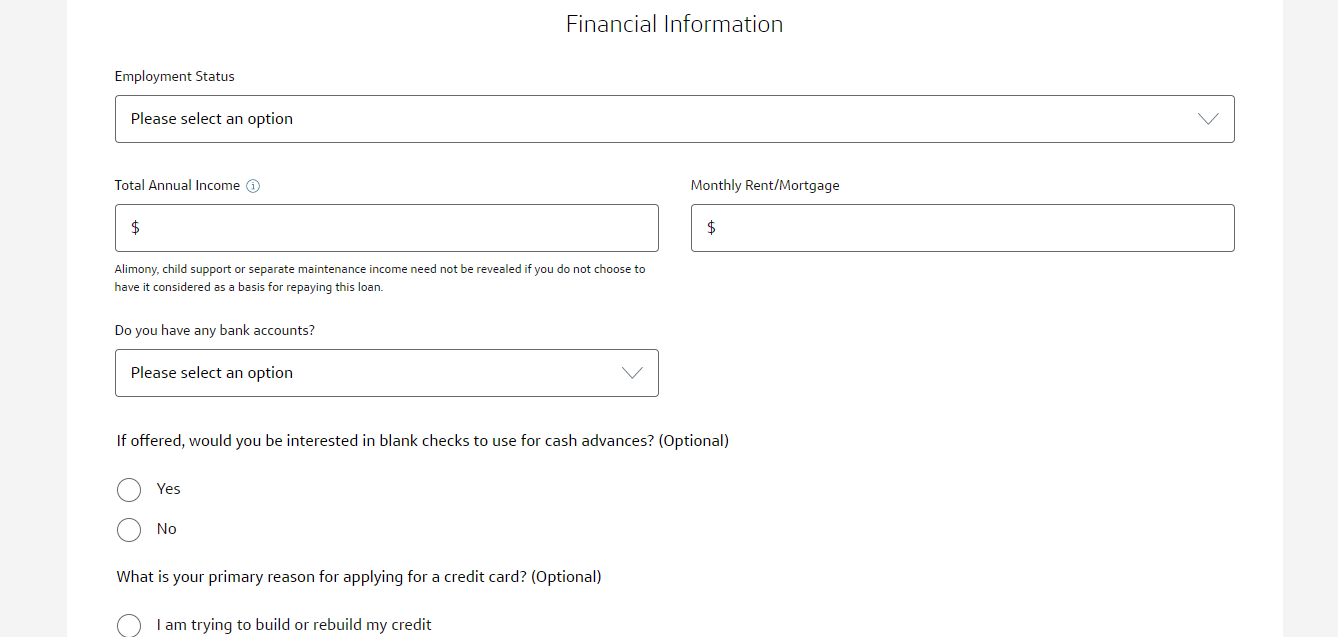

- There are a number of what to provides able to possess bank before you apply to own a consumer loan, plus monetary recommendations, work reputation, plus SIN.

- Different kinds of signature loans were secured personal loans and you may personal loans. Before getting a personal loan, compare mortgage options to come across which one enforce far better their novel disease.

You don’t have perfect credit scores so you can safer an unsecured loan, as there are no magic number with regards to reaching a certain matter to receive ideal mortgage costs and you can terminology, but lenders basically come across individuals with fico scores away from 660 and you can above as the lower exposure. People who have fico scores from 560 or here are likely to be for challenge being qualified to possess better loan terminology.

A consumer loan is actually a predetermined amount of cash which you commit to repay more a set amount of time. You can explore signature loans while they are considering renovations, autos, combining debt that offers highest rates of interest, or any other events whenever there’s not enough readily available money on hands. not, by the agreeing into financing, you need to pay off an entire count also attract and any charges of the they. Personal loans is repaid thanks to short otherwise much time-name resource preparations, and also by and also make regular costs named installments.

Your credit ratings make a difference what kind of consumer loan choices you can speak about and rates, costs or collateral which are often associated with they. Yet not, it is vital to observe that your own fico scores are among of several affairs that loan providers and you can creditors basically be the cause of when assessing your creditworthiness.

What is actually a good credit score?

Credit scores are determined into the an effective 900-point range and help determine the right you’ll shell out your expense promptly. Regardless if credit rating models differ, fundamentally fico scores out of 660 to help you 724 are thought an excellent; 725 so you can 759 are thought very good, and you will 760 and up are believed advanced.

- 760 so you can 900: Excellent

- 725 in order to 759: Decent

- 660 to 724: An effective

- 600 to help you 659: Reasonable

- three hundred to 599: Bad

Fico scores let anticipate exactly how more than likely it is that any particular one will pay right back its mortgage obligations once the decided. The different credit reporting habits will vary, however, loans in Coarsegold generally use your commission history, amount of credit rating and you will borrowing from the bank utilization. Find out about how credit scores is actually determined right here.

Overlooked repayments on the debt obligations

It is critical to stick to ideal of your own monthly obligations. Surface in making monthly premiums is a vital action for the good healthier credit profile.

With too many otherwise too little unlock borrowing profile:

Unnecessary discover borrowing from the bank profile can recommend so you can lenders that you are perhaps not in charge having credit currency, and you may too few profile may well not make it loan providers to have adequate information on how to deal with your bank account to attract a substantial conclusion.

Unnecessary borrowing from the bank software:

Whenever you are constantly applying for a lot more borrowing from the bank, it could improve a red-flag if for example the credit ratings is computed, as it can suggest that you are overextending what you can do so you can pay.

Which have large credit card balances:

Meanwhile, showcasing multiple samples of discover borrowing from the bank accounts that don’t enjoys late or skipped costs may improve your credit scores. Discover more about exactly what circumstances perception your own credit ratings otherwise learn how to look at your credit history right here.

Ideas on how to apply for unsecured loans

Before applying having a personal loan, there are records you will have ready to have loan providers. Per bank may need even more or some other records.

- Their a position status otherwise proof typical income

Lenders will normally check your credit report and you may credit scores, together with other guidance to check what you can do to settle brand new financing. This may feeling the readily available financing alternatives and you can words, such as rates of interest.

Form of personal loans

One which just verify for individuals who qualify for financing, you will want to examine the loan choices to look for what type enforce far better your unique problem, as well as what type of loan you really can afford.

Secured mortgage

A protected loan demands a global collateral – a secured asset you possess particularly an automible or home – so you can be eligible for the loan.

By providing collateral, the loan grew to become less risky on lender, as they can seize the collateral for folks who standard toward loan. Safer finance are generally open to whoever has experienced economic dilemmas prior to now or has actually a lowered credit history. Different varieties of secure fund were title finance, pawn fund, and secured loans.

Unsecured loans

Personal loans don’t need equity but can hold higher rates and higher credit scores than secured personal loans. Two of the fundamental benefits of an unsecured loan are you to it might promote smaller approvals and less files.

Contrasting loan alternatives

Examine loan possibilities, you prefer the full price of for each and every mortgage to determine what could be the most affordable for you in the long run. Yet not, some people will find the total cost of the loan more than time for you be much more crucial, while some ount is a much bigger consideration. Everything boils down to what you would like and want having your personal mortgage.

Of the casting a greater web and you may conducting lookup on competitive interest costs, discover the personal mortgage that is right for you.

That have Equifax Done TM Biggest, we display your credit score and get so you’re able to place signs of con. Just in case their name try stolen, we’re going to make it easier to recover.